All About What Is Trade Credit Insurance

Wiki Article

What Is Trade Credit Insurance for Dummies

Table of ContentsWhat Does What Is Trade Credit Insurance Mean?The 2-Minute Rule for What Is Trade Credit InsuranceExcitement About What Is Trade Credit InsuranceThe Facts About What Is Trade Credit Insurance Uncovered

This is used by some profession finance experts covering the potential hold-ups to settlement which could originate from money transfer limitations, or the bankruptcy of a federal government customer. Our political danger insurance coverage assists businesses to shield their overseas investments in scenarios such as political violence or confiscation of assets, or various other dangers concerning the actions of a foreign government.The costs is determined as a portion of the overall amount of earnings being insured, starting from around 0. 15% of insurable turn over. In some cases it does work out a lot higher than this if there is incomplete credit score history or various other warnings. Similar to any type of sort of insurance policy, there is a computation to be done around threat.

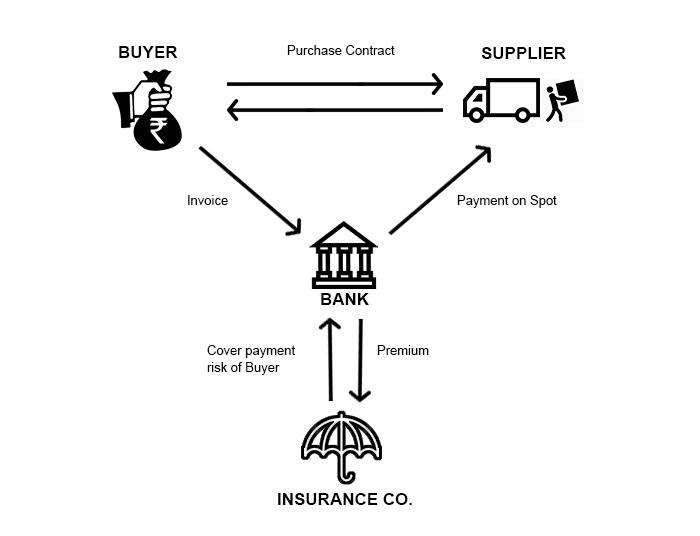

They designate each of those consumers a quality that reflects the wellness of their activity and the means they carry out business. Based upon this risk evaluation, each of your purchasers is after that given a particular credit line approximately which you, the insured, can trade as well as have the ability to case needs to something fail.

Not known Details About What Is Trade Credit Insurance

The warranties will cover trading by domestic companies and exporting firms and the intent is for arrangements to be in position with insurance providers by end of this month. The assurance will certainly be momentary as well as targeted to cover Covid-19 economic obstacles, and also it will be adhered to by a testimonial of the TCI market to ensure it can best support organizations in future.It is necessary to get the information right to ensure that the system works for organizations and insurance providers, as well as also uses value for money for the taxpayer. It is essential that insurance companies can preserve their underwriting requirements and risk monitoring techniques, to make certain that support is supplied to organizations that can trade out of the present situation - What is trade credit insurance.

Provided the abrupt interruption to financial activity, and the raised threats of bankruptcy and also default in the market, trade credit rating insurers might immediately take out a few of the insurance coverage that they presently provide in order to continue to be viable. The option would be to enhance costs to a degree that is wasteful for all parties.

Profession credit history insurance plays an especially substantial duty in non-service fields, such as manufacturing and building, offering businesses the confidence to patronize one an additional. The Government is eager to make sure that these fields are not take into more distress as a result of the Covid-19 dilemma. This scheme will ensure that supply chains remain to be protected from the potential cause and effect of profession interruption as well as business defaults.

Getting The What Is Trade Credit Insurance To Work

The information are still being finalised by the UK read this post here Government and also being discussed with insurers. The government is working with market to settle the information of the system.

The Federal government's top priority for this system is to function with insurance firms to support UK businesses. It is the Government's objective that this scheme will enable the profession credit market to run as normal, as far as feasible.

Not known Facts About What Is Trade Credit Insurance

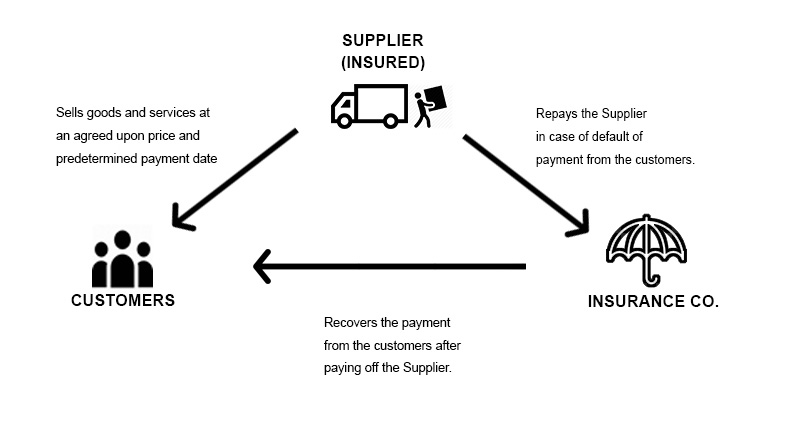

Further details of the system will certainly be announced eventually. The Federal government's concern for this plan is to sustain UK companies that might be affected by the withdrawal of profession credit report insurance coverage cover throughout the Covid-19 crisis. In the longer term, it will certainly be ideal to review the efficiency of this treatment, assess exactly how the marketplace replied to financial disruption, as well as think about exactly how it can remain click here now to ideal serve companies.Trade debt insurance supplies protection for companies when customers do not pay their debts owed for items or services. The policy will certainly repay the insurance policy holder in the event of the buyer's non-payment, up to a specific credit rating limit set by the insurer.

This can intensify the financial effects of the pandemic by triggering problems for liquidity and also working capital for customers and destructive count on supply chains.

The sales of goods and also services are revealed to a significant variety of dangers, much of which are not within the control of the distributor. The greatest of these risks as well as one that can have a disastrous effect on the practicality of a distributor, is the failure of a purchaser to spend for the items or services it has acquired. What is trade credit official website insurance.

Report this wiki page